Pay Less for a User on Any Ad Network – Portfolio LTV Analysis

Lidiia Mylenka

Lidiia Mylenka  Lidiia Mylenka

Lidiia Mylenka This guest post was created by Tabarak Paracha, Marketing Manager at Tenjin. Tenjin is a free-to-start, pay-as-you-grow advertising measurement solution for mobile game developers. Empowering mobile publishers with a distinctive approach to growth analytics, Tenjin enables them to punch above their weight. Starting from $300 per month, Tenjin users get access to all available products with no hidden costs or add-ons.

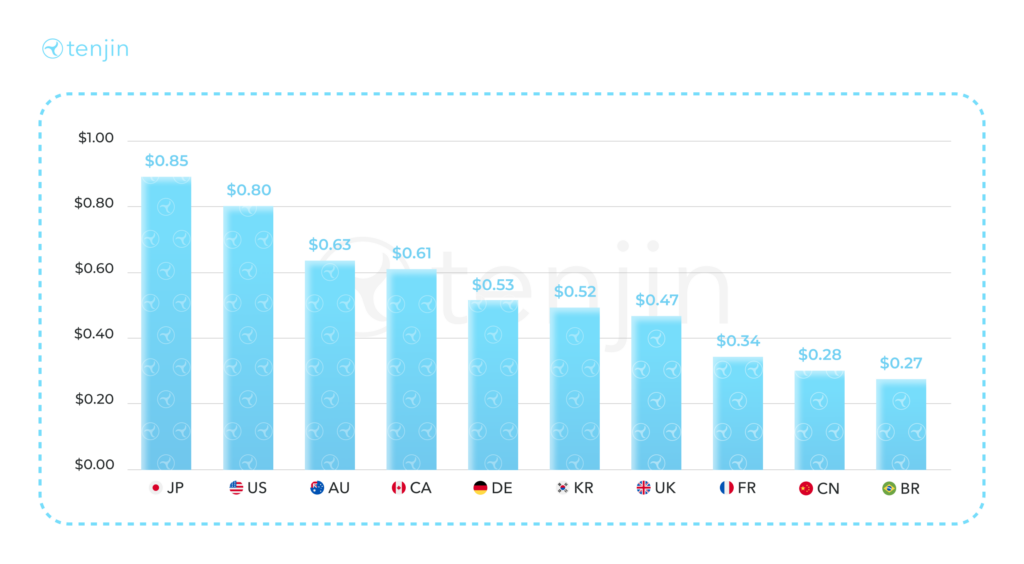

Navigating the mobile advertising landscape is growing increasingly complex. According to Tenjin’s ‘From Hyper to Hybrid in 2024 Report,’ even hyper-casual games, traditionally viewed as the most cost-efficient, are nearing the $1 mark for CPI (Cost Per Install) in the US.

The top ad networks and countries are changing rapidly, demanding that mobile marketers discover new methods of analyzing their data to get ahead of the curve. Standard dashboards often fall short in addressing specific business requirements due to their lack of customization for innovative analytical scenarios.

Below, I delve into an approach that any mobile marketer with more than one app can use to scale their ad campaigns: Portfolio LTV Analysis.

This post will be structured in the following way: first, I will inform you of three popular use cases that can help you boost your advertising campaigns. Next, I will provide you with the prerequisites necessary for their implementation.

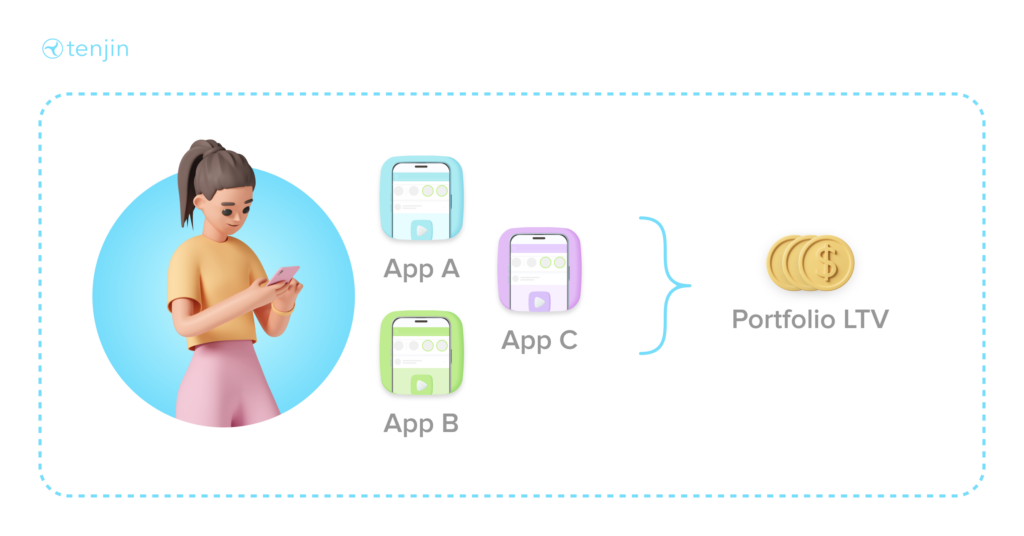

In a nutshell, Portfolio LTV, short for Lifetime Value, refers to the cumulative value that a user generates across all apps within a publisher’s portfolio.

Consider a scenario where you have a table containing users along with the amount of games they have played from your portfolio. Leveraging this table, you can pinpoint the most valuable users currently engaged with your apps and target them with cross-promotions instead of traditional ads. Ordinarily, you might split your approach evenly, displaying 50% cross-promotions and 50% ads to your users. However, once a user is identified as a high-value portfolio user from looking at their 90 Day Portfolio LTV as shown in the image below, you can adjust your strategy to display 80% cross-promotions, guiding them towards other games in your portfolio, while limiting ads to just 20%.

I have sketched an example of what such a table would look like below. If you were only focused on the Average 90 Day LTV per app as a user acquisition manager, you might not have noticed that the users in rows 2 and 3 are actually high-value. But if you take a wider perspective and look at their 90 Day Portfolio LTV ($3.50 and $1.30 respectively), it’s clear that these users are indeed valuable.

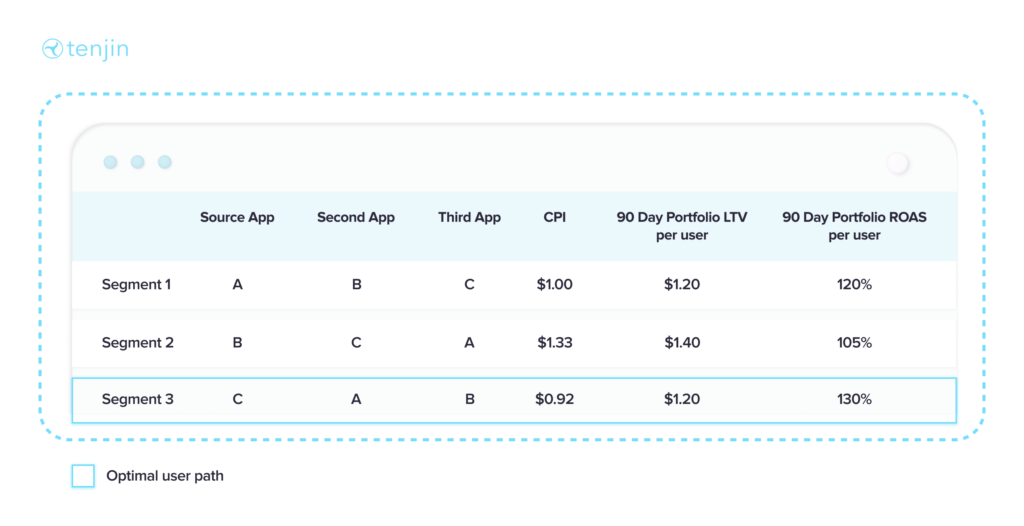

Imagine you have large segments of users who were exposed to cross-promotion across your various games or apps. By analyzing the paths these users took and calculating metrics like 90 Day Portfolio LTV per user and 90 Day Portfolio ROAS per user (portfolio LTV per user divided by CPI), you can pinpoint the most effective user journey within your app portfolio. For instance, let’s say you have only three apps in your portfolio, and the highest 90 Day Portfolio ROAS per user, as well as the lowest CPI, occurred in the segment of users that moved from App C to App A to App B, as shown in the illustration below.

This suggests that acquiring users from App C is the most cost-effective, as they generate the highest revenue when they progress from App C to App A to App B. Once you’ve identified this optimal path, you can then allocate more advertising budget to App C, and increase cross-promotions from App C to App A and then to App B.

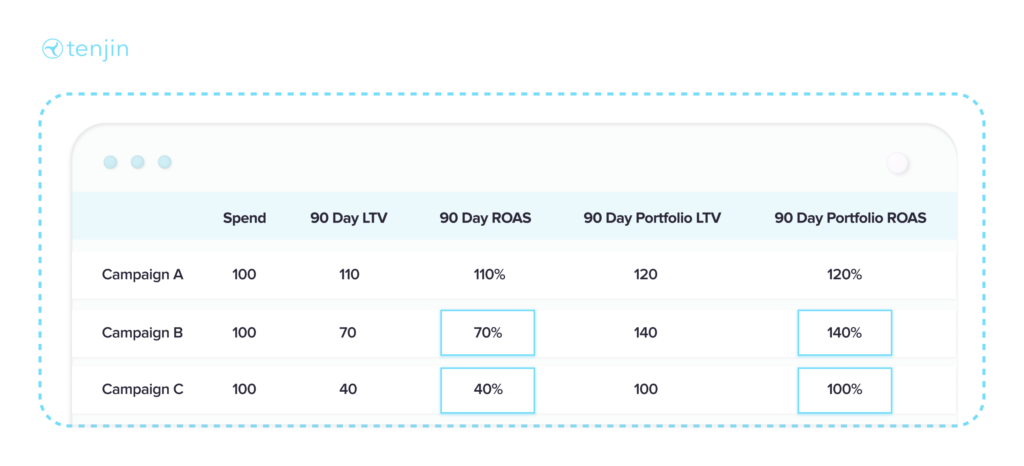

In this use case, you’re examining Portfolio LTV data at the campaign level. Typically, you assess campaign data for a single app, but now you can evaluate how successful a campaign is in terms of overall Portfolio LTV and Portfolio ROAS.

Looking only at the 90 Day LTV or 90 Day ROAS for each individual app, as shown in the illustration below, could cause you to miss that the campaigns in rows 2 (with a 70% 90 Day ROAS) and 3 (with a 40% 90 Day ROAS) are actually high-value.

However, when you take a broader view and analyze these campaigns at a portfolio level, you can see that they significantly contribute to the overall 90 Day Portfolio ROAS, which is 140% for campaign 2 and 100% for campaign 3. This suggests that increasing spending on campaigns 2 and 3 and monitoring their performance closely might be a good strategy.

As we step into 2024, it’s evident that many mobile app developers overlook the significant impact of the network effect when assessing campaign performance. Typically, user acquisition managers gauge the ROI of their campaigns solely within the context of a single mobile app, adhering to conventional methods. Yet, I propose a fresh perspective. Imagine if a user acquisition manager could accurately quantify the total value generated by a user across all apps within their game portfolio. Armed with this insight, they could strategically increase their bids and revolutionize their ad monetization strategies.

Another advantage is that a user acquisition manager could then target specific users who demonstrate a propensity to engage with multiple games in their portfolio, as illustrated in the example provided earlier. It becomes apparent that these users have an affinity for your games and are more likely to explore additional titles within your portfolio. By adopting this perspective, the marketing team can unlock numerous use cases that leverage the entire portfolio of games, rather than focusing on individual titles.

Consider Hyperbeard as an example. Through the implementation of Portfolio LTV, this leading mobile publisher from Mexico with 210 million downloads was able to increase their ROAS by 20%, and LTV by 35%. We had the opportunity to speak with Alex Kozachenko, CEO of HyperBeard, to delve deeper into their success story.

You can also read about it in our HyperBeard case study.

Initially, this novel approach to analysis may seem daunting, particularly for smaller publishers. Nevertheless, in practice, most publishers already possess the necessary resources and tools to get started with Portfolio LTV analysis.

In the following section, I delve into the essential prerequisites required to initiate Portfolio LTV analysis.

1. MMP (Mobile Measurement Partner)

2. Cross-promo campaigns

3. Data Warehouse

4. Data Pipelines (ETL)

In brief, a MMP (Mobile Measurement Partner) is a tool that helps advertisers to programmatically and unbiasedly assess how well their advertising is doing. They aid advertisers in comprehending their campaign’s effectiveness, and pinpointing the top-performing channels for their app.

Conventionally, advertisers think about a MMP as a dashboard that displays ROAS/ ROI, Retention and LTV.

However, in our unconventional approach, the role of a MMP goes beyond that. A MMP is able to give you access to an iceberg of data and insights on top of its dashboard, as is the case with Portfolio LTV. For the Portfolio LTV analysis, you will need to crunch the raw data that is not available in the dashboard. Companies that effectively leverage this data gain an advantage over their competitors.

YSO Corp is a mobile game developer that reached a mark of 1 billion installs, attributing their success to their ability to go beyond what everyone else is doing. Here is what YSO Corp’s Co-founder said about Tenjin, after reaching 1 billion installs.

Watch the full video if you are interested in learning the secret behind YSO Corp’s success.

Once you are set with a MMP, you need to get access to that data iceberg somehow. There are several ways you can do this. You can either export all the raw data that you have on a regular basis manually and upload it to your database. Alternatively, you can set up some sort of automation for Amazon S3 buckets, or deploy endpoints that will collect the data that you send from your MMP via callbacks. In all these cases you need to have a data team that will set up and maintain the data transition and storage.

This is why Tenjin created a Marketing Data Warehouse as a service called DataVault. It provides quick, reliable, and cost-effective access to marketing data. Basically, all of the data that advertisers might need is available in one place, without any extra effort or resources.

Once you have it set up, it really feels like magic. Here is what Marc Wofford. Director of Data and Analytics at Kooapps, thinks about DataVault:

By the way, one of the use cases for Kooapps and DataVault is also cross-promotion. You can read about it, as well as their other use cases, in more detail here.

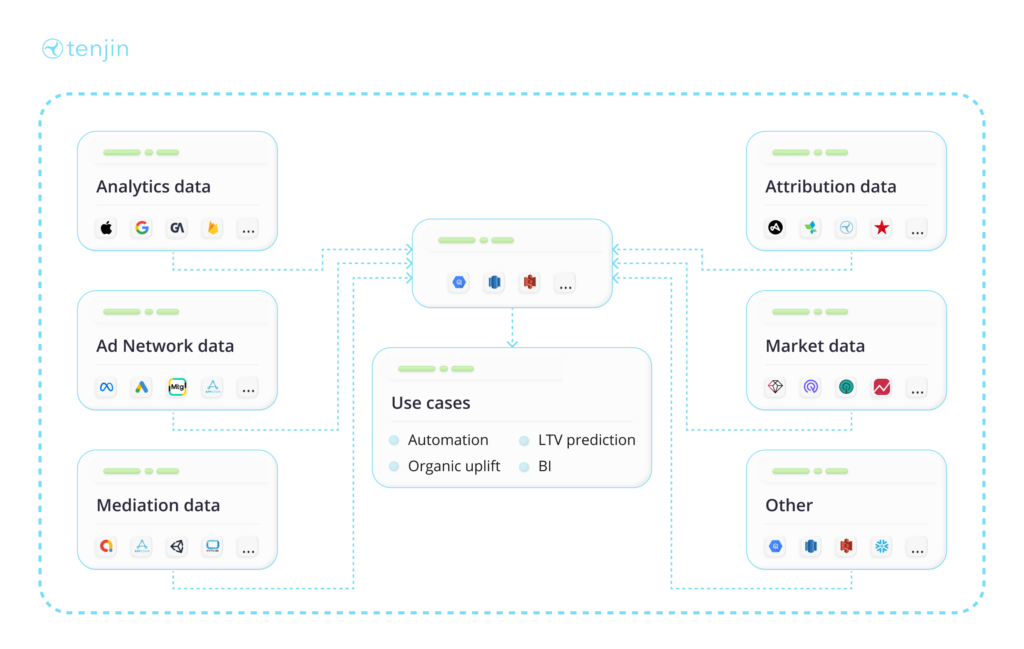

Finally, if you already have a data warehouse with your own data, and you just want to merge it with your marketing data, automated data pipelines are the solution for you.

Experienced mobile marketers employ these automated data pipelines to enrich their insights. As depicted in the diagram below, these pipelines enable mobile marketers to integrate data from various sources and tools into their data warehouse.

By doing this, mobile marketers are able to conduct advanced analyses, such as expanding data dimensions or utilizing custom metrics. Furthermore, marketers can develop additional use cases, including organic uplift, LTV prediction, Marketing Mix Modelling (MMM), user behavior or funnel analysis, and beyond.

Let’s consider a scenario where we combine attribution data with product analytics data. A common scenario we encounter involves determining the balance between users’ time spent in your app and their in-app spending. Achieving this entails merging ad revenue and user acquisition data from your attribution provider with custom events data from your product analytics tools like Firebase or GameAnalytics. Conducting such an analysis empowers you to optimize your marketing campaigns effectively.

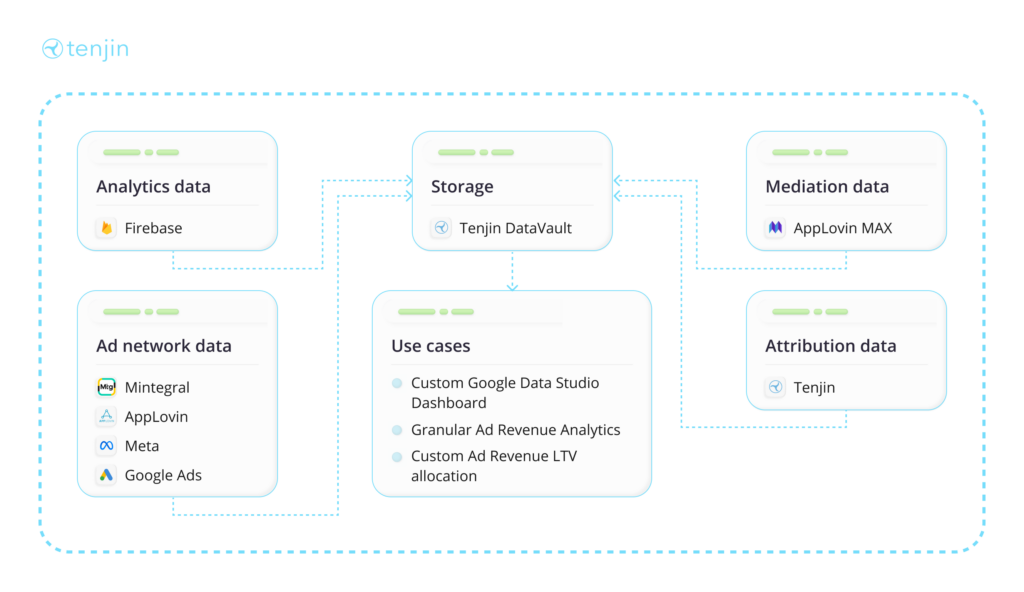

Tenjin’s product, GrowthFullstack, is a complete data pipeline platform that empowers mobile publishers to unify complex data sets without the need for in-house data engineering teams. Below is a real example of Touka Games’ setup with the help of Growth FullStack.

Read more about the Touka Games case study here.

Finally, in order to do the analysis for Portfolio LTV, you need to have more than one app, and you should be willing to do some cross-promotion.

Cross-promotion within mobile marketing entails developers showcasing an ad for one of their apps within another app that belongs to the publisher’s portfolio.

If you’re a mobile marketer with multiple mobile games in your portfolio and aren’t leveraging cross-promotion in your user acquisition strategy, you might be overlooking a valuable opportunity.

By integrating cross-promotion into your user acquisition strategy, you can retain users within your portfolio of games, while reducing the cost of acquiring users for your new games.

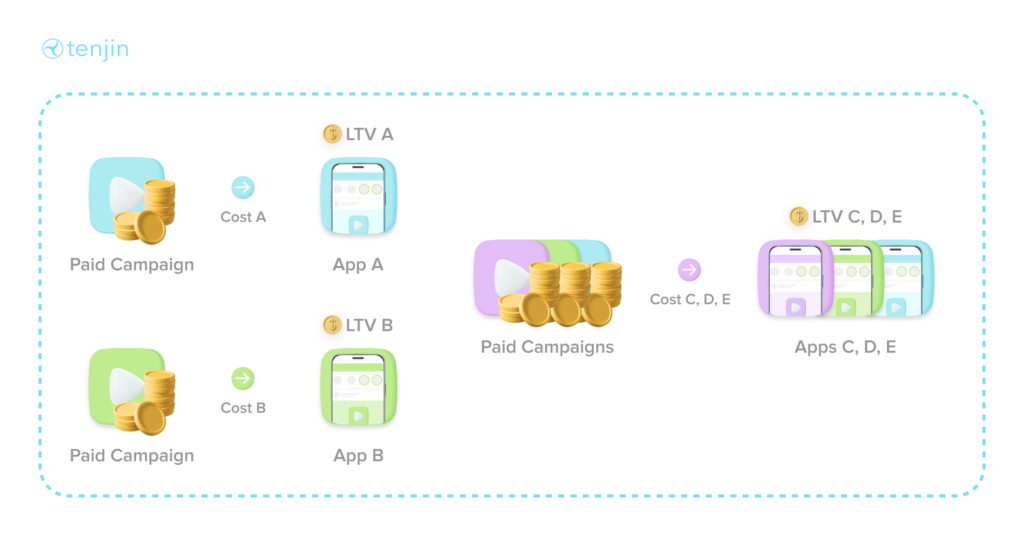

Pictures speak louder than words. The diagram below shows how a user might navigate through your collection of apps after being acquired by “App A” at an initial cost via a paid user acquisition campaign.

By considering the LTV generated by this transition, you’ll realize that, when maximizing the ROI, solely examining the LTV of App A doesn’t capture the full impact of the user moving among your other apps. Instead, your maximized ROI is the sum of all the LTVs of each user as they progress through each app, minus the initial cost of acquiring the user for App A.

Here is what the formula for maximizing the ROI for your portfolio of users would look like:

For sake of comparison, let’s now look at the usual scenario where mobile marketers are not using cross-promotion. The diagram below depicts this situation.

In this scenario, ROI is maximized as the total of LTVs across apps, minus the cost incurred from acquiring users through paid campaigns for each individual app as depicted in the formula below.

As Christopher Farm, CEO at Tenjin, points out in his insightful article on cross-promotion, “A common mobile marketer is trained to shut off any campaign that has negative ROI over a certain timeframe.” This behavior stems from optimizing campaigns and maximizing ROI based solely on the performance and KPIs of individual mobile games or apps. Mobile marketers need to broaden their perspective to maximize ROI across their entire portfolio. As Farm emphasizes: “Smart app developers think about maximizing their portfolio ROI, not just their individual apps’ ROI.”

Incorporating cross-promotion into your user acquisition strategy allows you to bid higher for new users outside of your portfolio. These players will transition to other games within your portfolio, resulting in more valuable players. A secondary effect of bidding higher is an increase in the number of players within your app ecosystem allowing for more profitable growth.

Maximizing ROI for each individual app typically results in increased acquisition costs. However, leveraging the portfolio to acquire users across multiple apps without incurring additional cost allows you to capitalize on the advantages of owning multiple apps and optimize ROI uniquely for each one.

Cross-promotion offers a non-intrusive and relevant way to broaden the reach of new games. Players typically welcome the opportunity to engage with games sharing similar designs, rendering cross-promotion an efficient tactic for broadening your audience.

Tenjin offers a free-to-start, pay-as-you-grow advertising measurement solution for mobile game developers. Empowering mobile publishers with a distinctive approach to growth analytics, Tenjin enables them to punch above their weight. Starting from $300 per month, Tenjin users get access to all available products with no hidden costs or add-ons.Tenjin has played a crucial role in the growth of studios, including Ruby Games, Voodoo, Kooapps, and Say Games, and is currently trusted by more than 25,000 apps and 300 platform partners.

Starting to use Tenjin is incredibly straightforward for users. With their all-inclusive plans, mobile marketers can access flat and transparent pricing, which is unparalleled in the market.

Moreover, Tenjin’s self-service platform allows users to sign up for free at any time and enjoy the benefits of the Free Plan, which includes 2,000 attributions per month (and 24,000 attributions per year).

Furthermore, Tenjin provides detailed and personalized demos conducted by dedicated Account Executives. Users can easily book a demo through the website at www.tenjin.com.

Growth FullStack, a product of Tenjin, is a no-code data pipeline platform designed for mobile publishers.

With Growth FullStack, we can:

You can get started completely for free via our self-service platform. Book a demo here to learn what use cases could help your business scale.