Running App Store Search Tab Ads: Results and Statistics

Nadezhda Ovchinnikova

Nadezhda Ovchinnikova  Nadezhda Ovchinnikova

Nadezhda Ovchinnikova Since Apple Ads introduced a new ad placement just last week, the topic of App Store Search tab ads is vehemently discussed among mobile marketers. What are its pros and cons of this promotion slot compared to Apple Ads search results campaigns? What is the value to set and outcome to expect?

Here, you will find results of running Search tab ads with averages per category and geographic market. We’re happy to share them so you can make unbiased, data-driven decisions about new inventory from Apple Ads.

Below you will find the full list of metrics analyzed. Each includes averages, data by categories, as well as data by countries and regions:

For that, we’ve researched nine popular categories so you can compare your app to the early results:

You can find more data to compare new Search tab ads performance in SplitMetrics’ Apple Ads Benchmark Dashboard.

While search results campaigns in Apple Ads use a cost-per-tap (CPT) model, Search tab campaigns use a cost-per-thousand-impressions (CPM) model. For more information on how impressions for App Store Search tab ads are calculated, check our blog post.

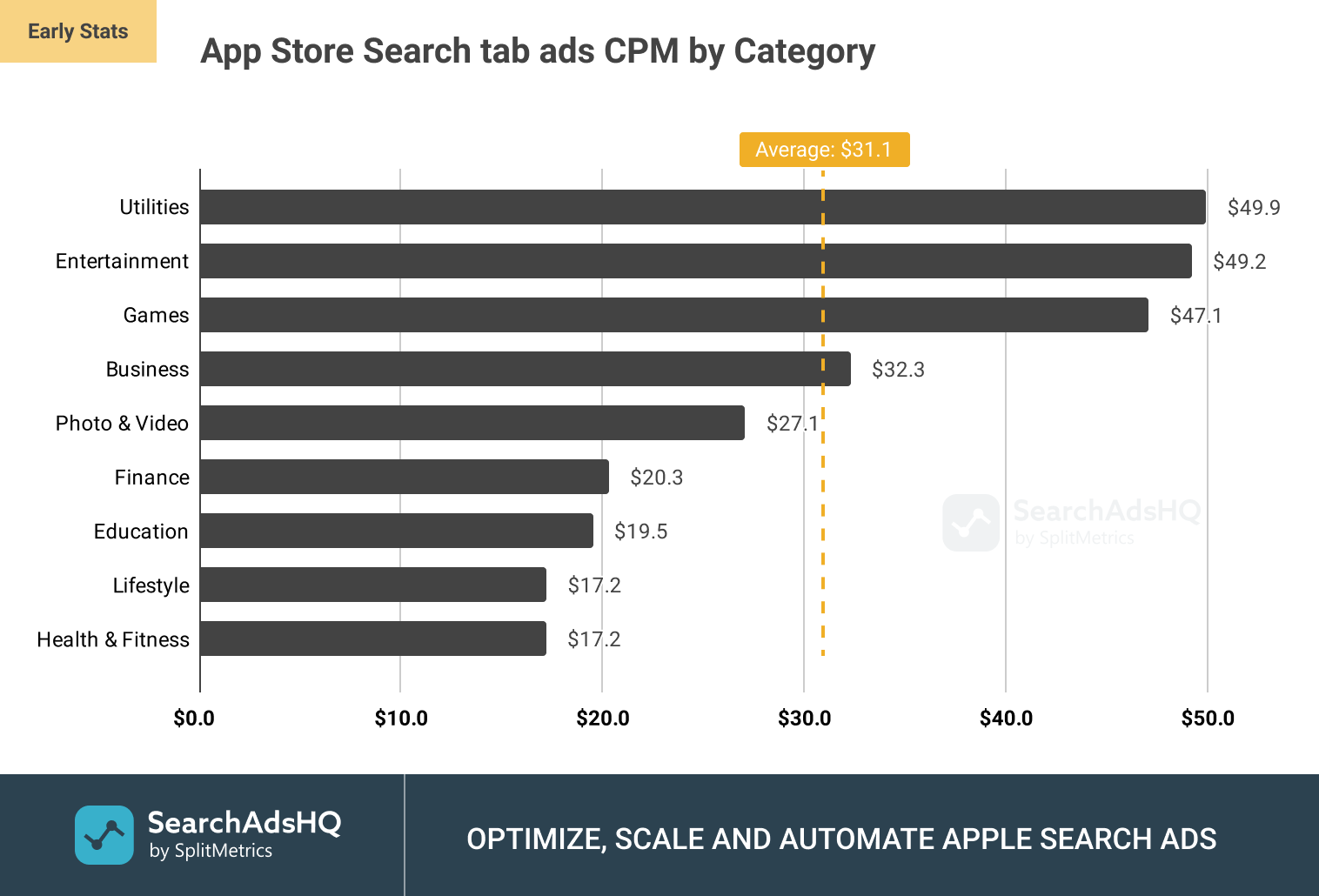

According to early data, the highest CPM is for apps in the Utilities category ($49.9), followed by Entertainment ($49.2) and Games ($47.1). The lowest is for Health and Fitness apps ($17.2), with the average value across categories of $31.1.

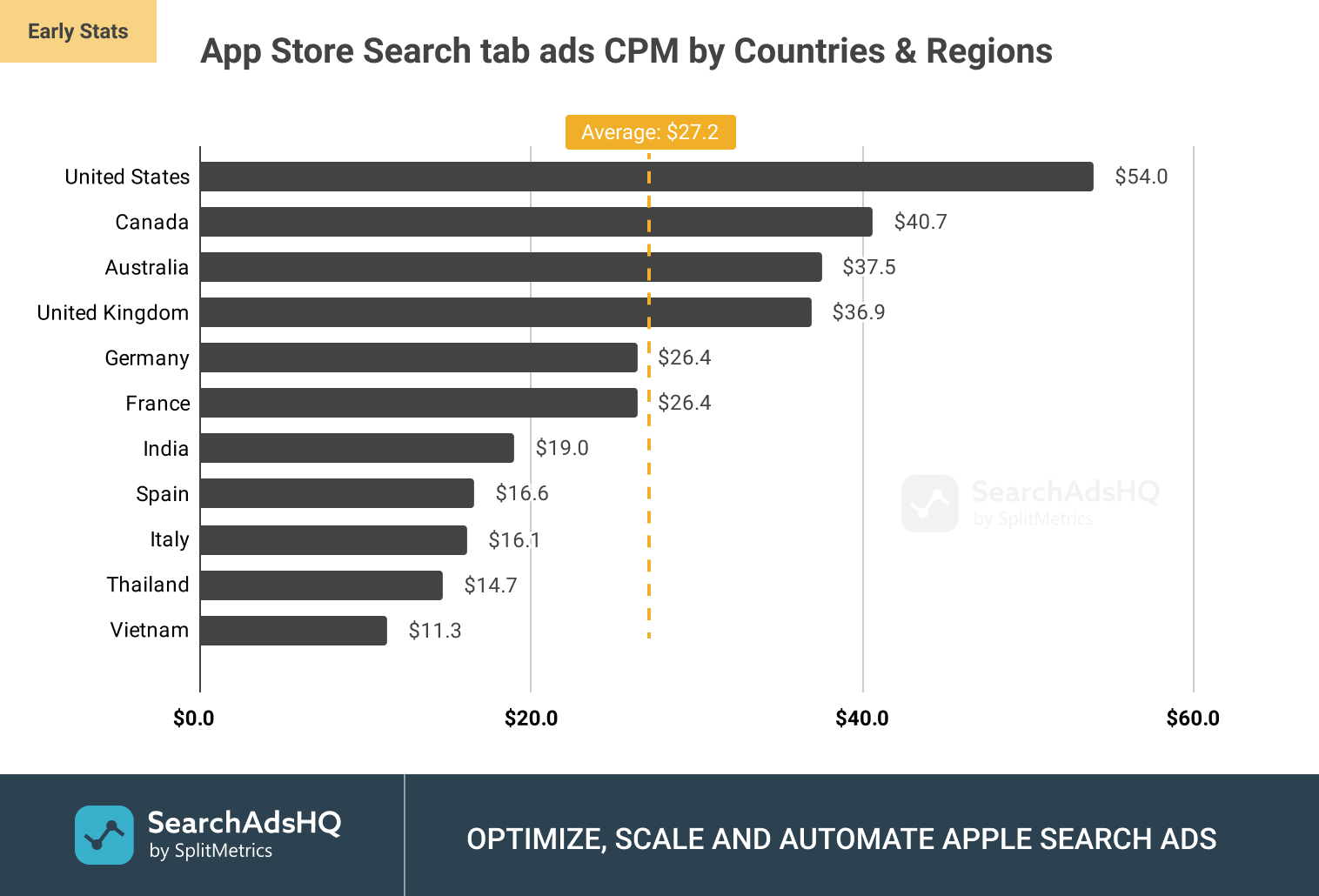

It’s no surprise the top five countries and regions are the United States, Canada, Australia, the United Kingdom, and Germany. The average CPM in the US is $54 and the average CPM in Canada is $40.7. Judging by early statistics, the CPM price gap in the top five countries and areas exceeds $27. Countries and regions with lowest CPM include Vietnam and Thailand.

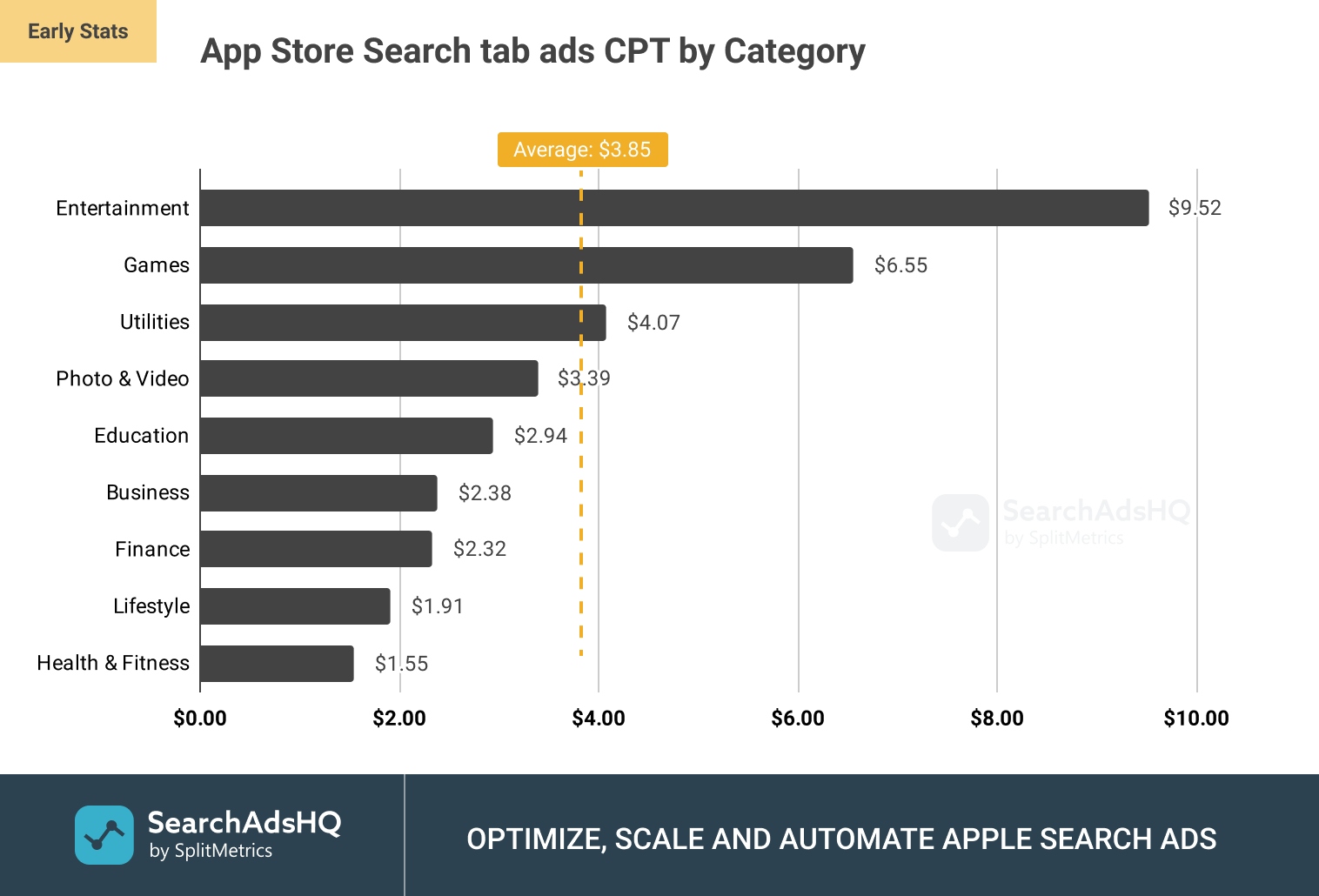

Advertisers with highest cost per tap are in the Entertainment ($9.52), Games ($6.55) and Utilities ($4.07), while CPT for Health and Fitness apps is at $1.55.

The average CPT for search tab ads across all industries is $3.85. This number is higher if compared to the average value of search results campaigns for Q2-Q4 2020, which is $1.10. (You can find more data in Apple Ads Benchmark.) However, keep in mind that these two types of campaigns are used to achieve different marketing goals and thus cannot be compared head to head. You will find detailed recommendations what types of marketing campaigns to run via search tab ads at the end of this post.

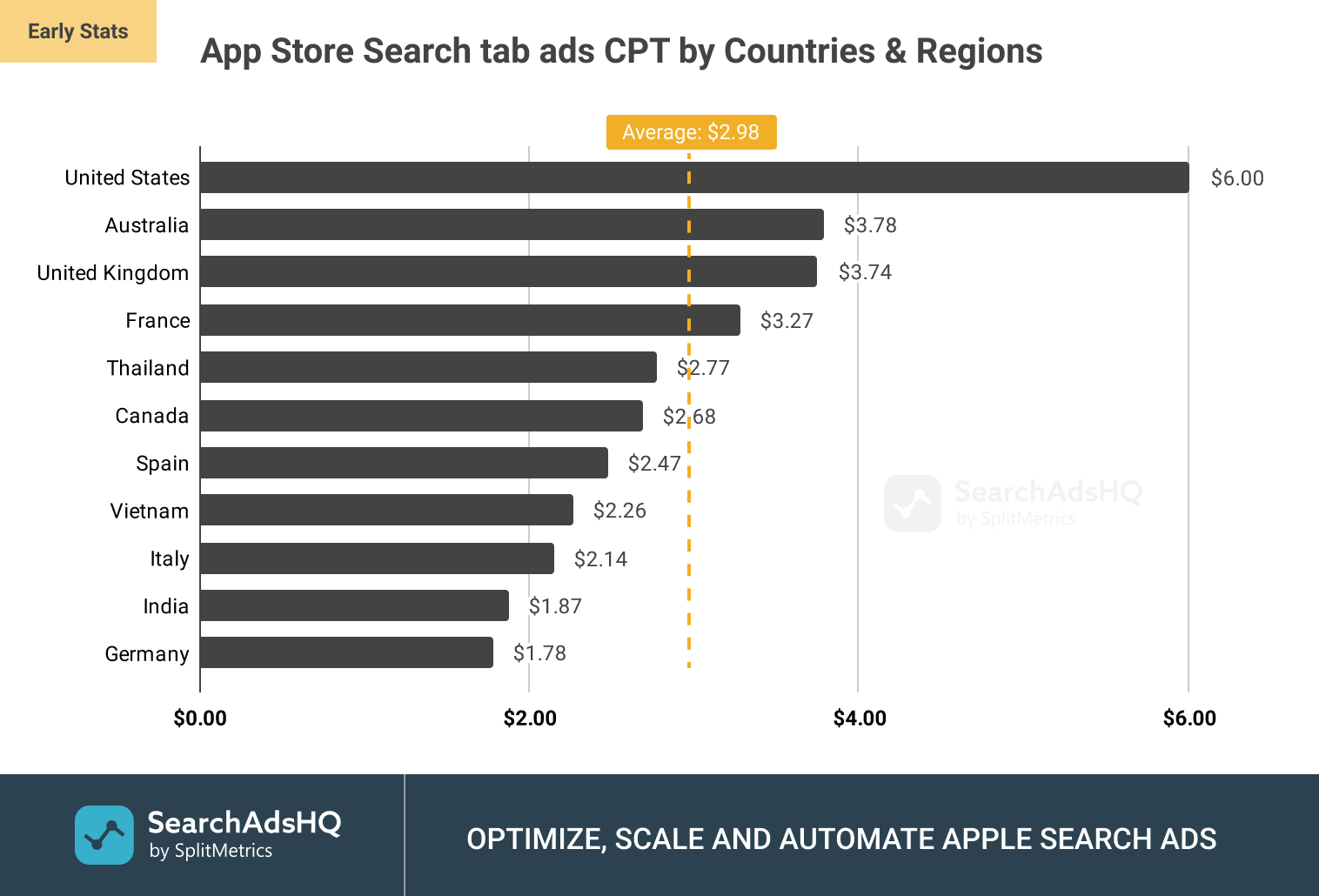

Again, among the storefronts with the highest CPT are the United States ($6.00), Australia ($3.78) and the United Kingdom ($3.74). The cheapest taps on App Store Search tab during the first week after introducing a new promotion slot, are for Germany ($1.78), India ($1.87) and Italy ($2.14). The average CPT across all locations is $2.98.

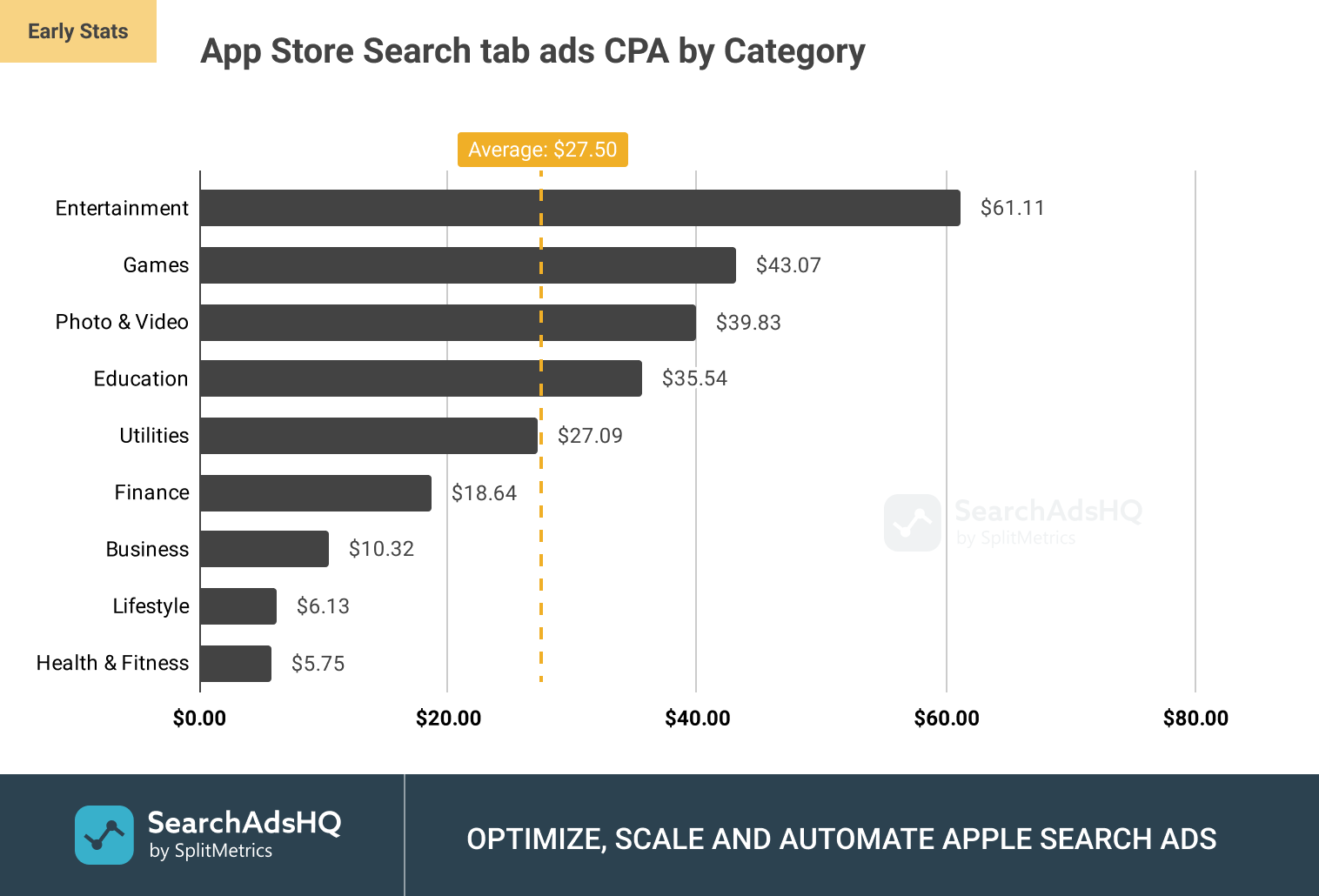

Cost per acquisition is expected to be high for this type of placement since the ads are shown to a wider audience. And the early data confirms it: the highest CPA is for Entertainment ($61.11), Games ($43.07) and Photo & Video apps ($39.83).

Judging by the average value, Search tab ads is not a marketing channel to be prioritized for user acquisition. If for search results ads, the average in Q2-Q4 2020 across all industries was $1.78, for App Store Search tab ads, it is $27.50. Over 15 times higher! To get more users to tap on the Get button on the App Store product page, use search results ads and optimize visuals and app title via A/B testing.

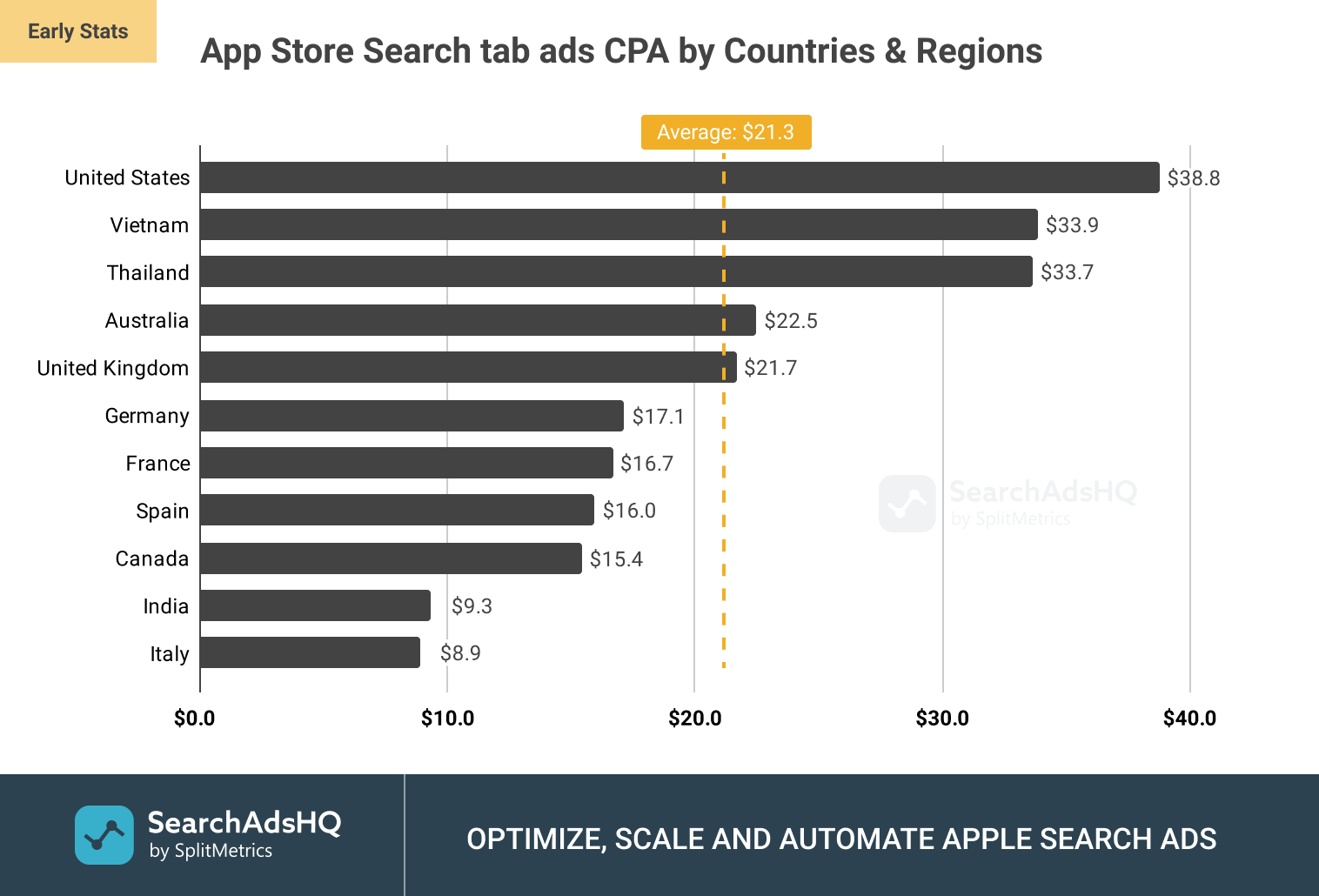

In current research, besides the United States ($38.8), Vietnam ($33.9) and Thailand ($33.7) are the markets with the highest average amount a campaign has paid for an install. Italy ($8.9) and India ($9.3) have shown to be around four times lower.

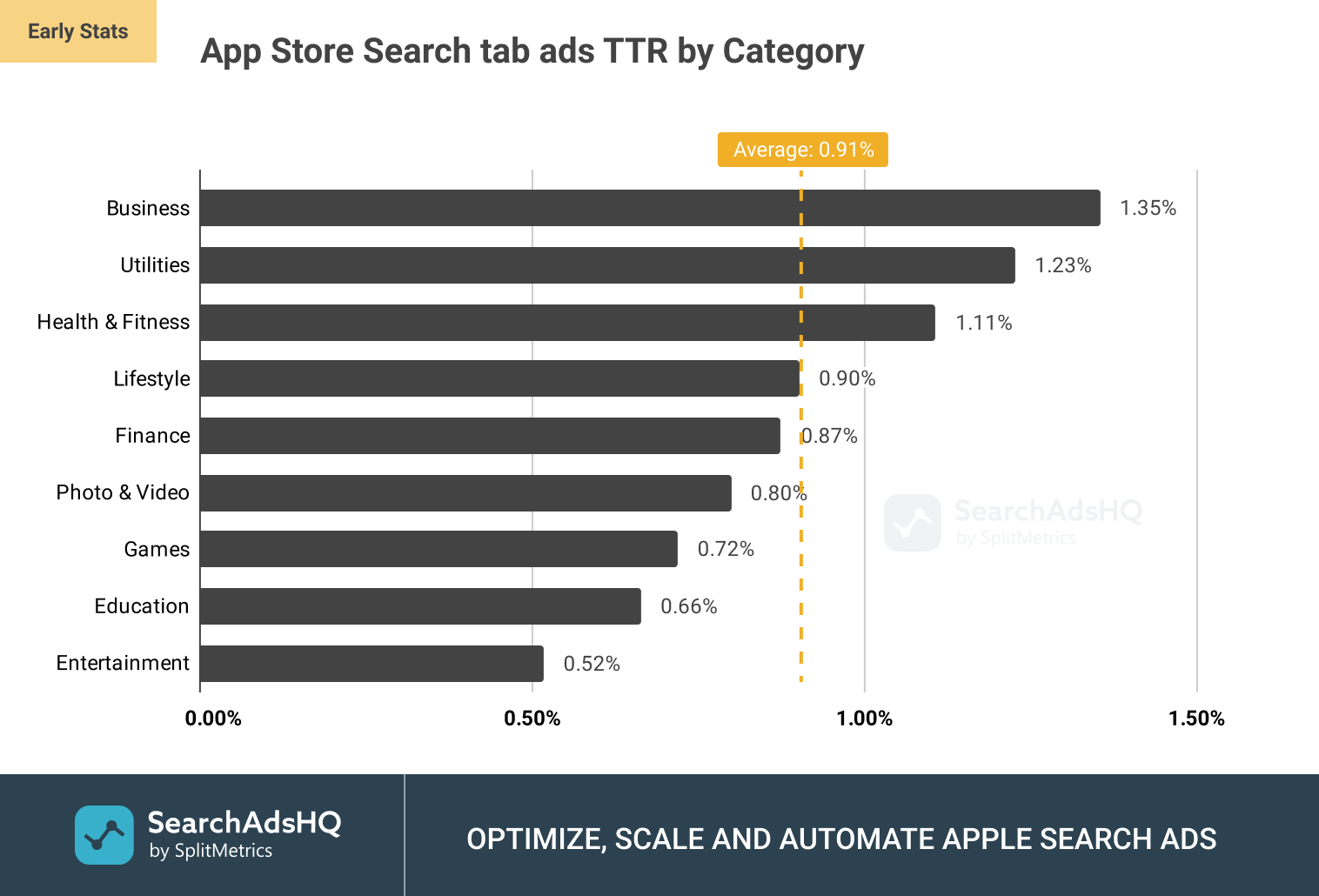

Standard search results campaigns that were previously the only option in Apple Ads, are characterized by a high average tapping factor: in Q2-Q4 2020 it was 6.27%. The average tap-through rate for the new promotion slot is more of a standard one across the industry. It is comparable to that of Facebook ads (0.90%) and equals to 0.91%.

For Business and Utility apps the average TTR is higher, 1.35% and 1.23%, respectively. For Entertainment it goes down to 0.52%.

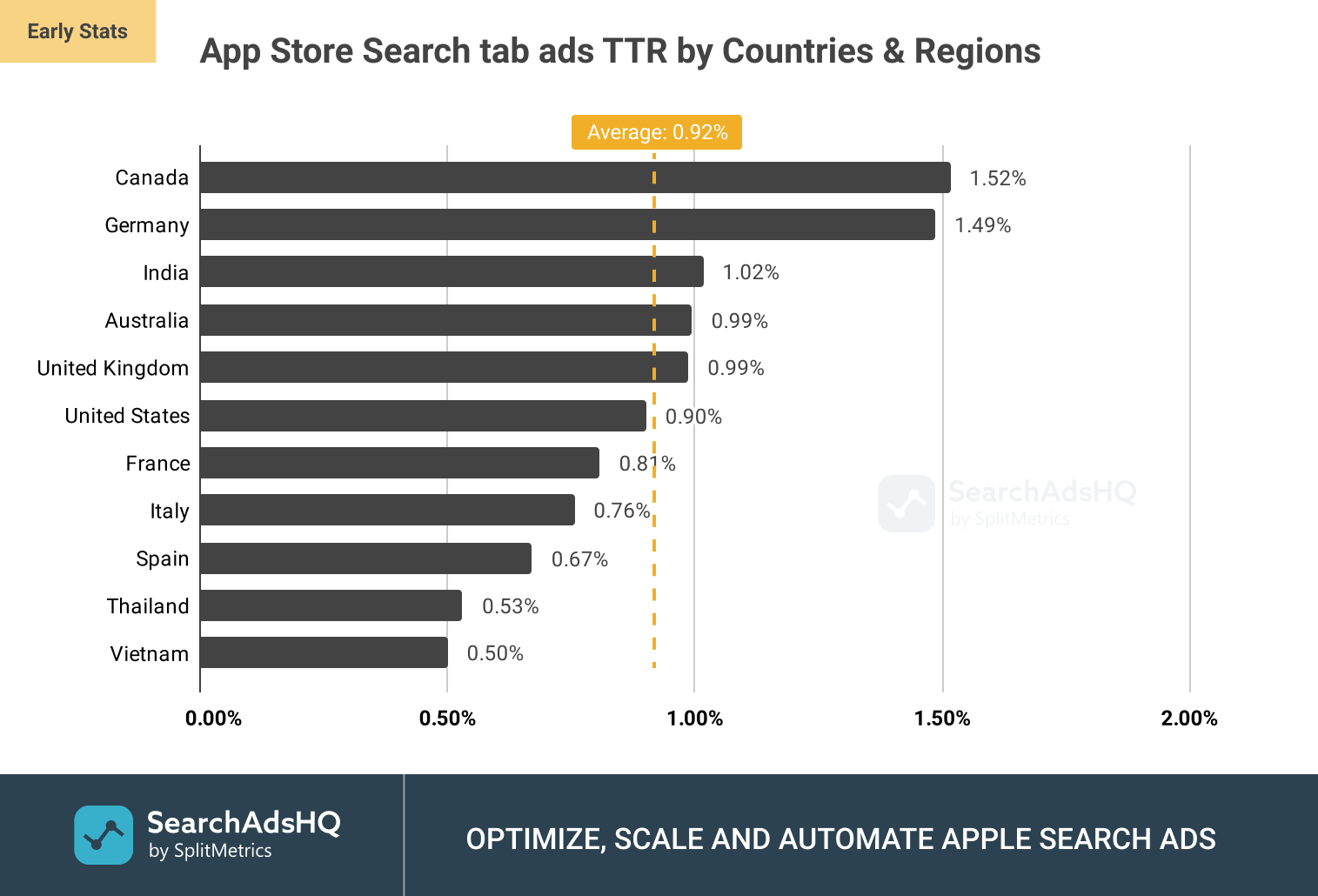

As for TTR statistics across countries and regions, Canada is at the top of the list with 1.52% for now, followed by Germany (1.49%) and India (1.02%). In Vietnam (0.50%), Thailand (0.53%) and Spain (0.67%) users seem to be less interested in ads shown.

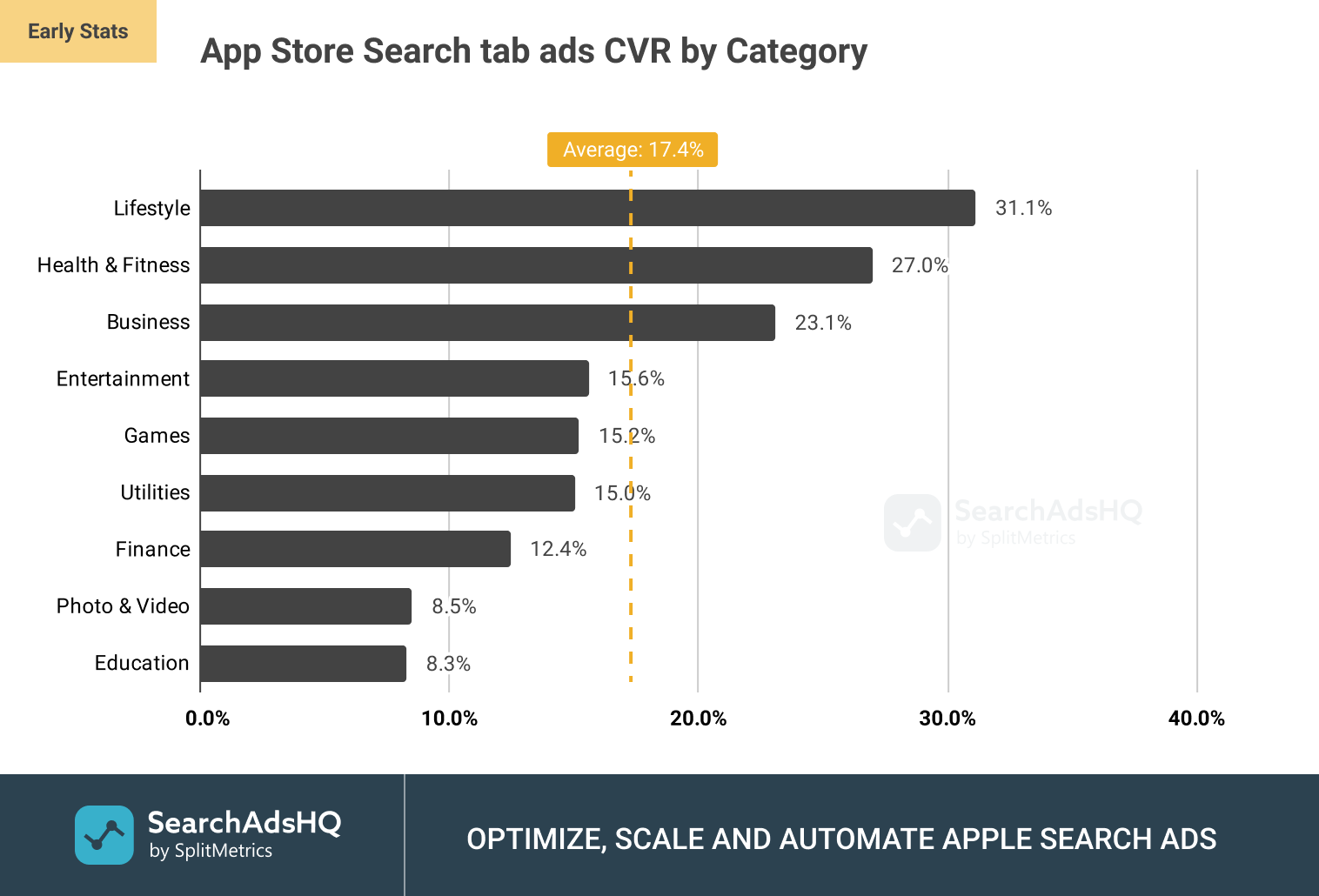

Conversion rate statistics obtained by testing search tab campaigns confirms the idea that new placement is highly competitive for user acquisition. If we are talking about search results campaigns, they convert at remarkably high rates, averaging 48.39% in Q2-Q4 2020. For App Store Search tab ads, the average is 17.4%. Still, they compare favorably to Facebook ads, for which the average conversion rate is only 9.21%.

Per category, Lifestyle (31.1%), Health and Fitness (27.0%) and Business (23.1%) showed more opportunities to create conversions, while Photo and Video (8.5%) and Education (8.3%) were less promising.

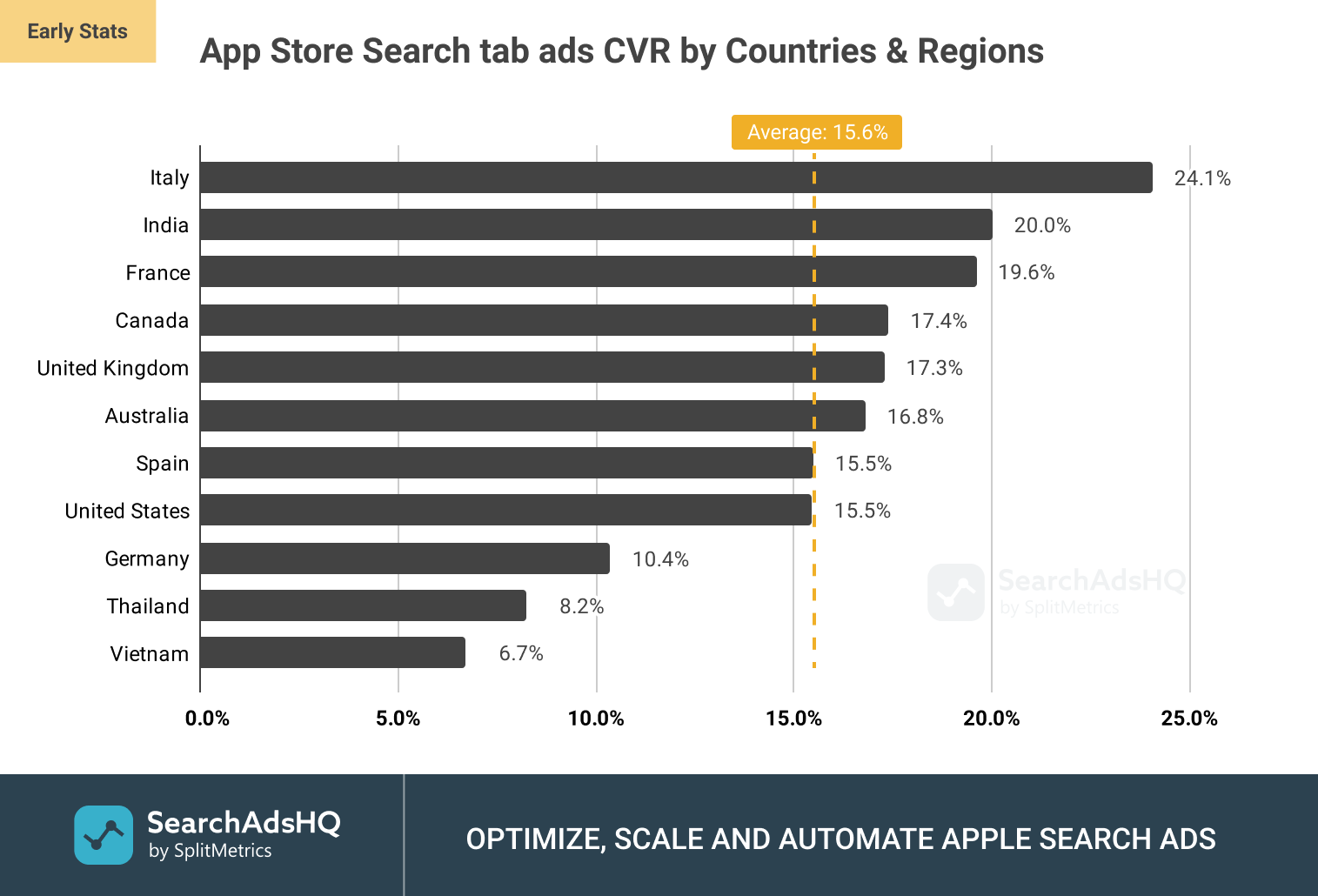

With more data to come as users update to iOS 14.5 and engage with a new ads slot, we’ll see how conversion rate for search tab ads varies across different countries and regions. As early results go, CR is better for Italy (24.1%), India (20.0%) and France (19.6%), while Vietnam (6.7%) and Thailand (8.2%) are ranked lower.

As statistics on CPT and CPA clearly shows, standard search results ads deliver extremely good results across all stages of a user acquisition funnel. App Store Search tab campaigns may not benefit as much from the lead generation standpoint and consequently have much lower conversion rates. CR is still above average across other advertising placements in the industry, and TTR is comparable to Facebook.

If you’re willing to invest in brand building, reaching wider audiences and aim at long-term rewards, App Store Search tab campaigns are worth the cost. A marketing campaign gets good exposure, since no additional actions are required for a user to see the ad on the Search tab. Users have not yet grown accustomed to this promotion placement and may pay more attention to it.

When measuring and evaluating performance data, let’s keep in mind that these are still early results. As more users adopt iOS 14.5, we’ll see a clearer picture.

It’s no secret that marketers want to get the biggest ROI from their advertising spend. For starters, I would recommend setting reasonably moderate CPM values and actively using daily caps. If a campaign performs as expected, simply move on to bolder CPM bids.

To reengage customers who have previously downloaded your app, the App Store Search tab ads can be a useful tool. The ad will remind a user of the app that was previously installed, if churn rate is an issue. If one of your objectives is to increase DAU, retargeting allows you to catch the eyes of users with an ad before they become inactive. As a result, these returning users will convert more often and possibly bring repeat sales of a higher average order value than first time buyers.

Consider this example: a UA campaign is first run via Google Ads for a Finance app. Here, we can use CPM-based Search tab ads to retarget leads and work them further down the funnel. Mixing in more retention with your acquisition efforts across different channels can be an excellent ally.

The logic behind new ads placement is different if compared to search result apps. Instead of focusing on the keywords and matching user’s query, here Apple Ads algorithm factors in user’s actions. This means, CPM- and CPT-oriented campaigns are not mutually exclusive, they can work in tandem.

If you are already running ads for all top-performing keywords most relevant to your business, while still not having exhausted the marketing budget, the App Store Search tab campaigns broaden the opportunity to achieve marketing objectives.

The tendency is that across all channels, formats and data in the advertising landscape, machine learning now does more and more of heavy lifting. Be it Apple Ads, Google or Facebook, algorithms evolve to process changing data on the fly and evaluate the best ads opportunities in real time.

As the algorithm for App Store Search tab ads will get better, we can expect further targeting refinement and performance optimization for Search tab campaigns. Machine learning operates with the full extent of data users agree to share, including user interests and behavior patterns. Such under-the-hood targeting might bring audience insights not so obvious to UA teams.

If you keep your finger on controls, letting the automated campaigns deliver the marketing goals you set is a really smart move for sustainable app growth.

To stay on top of what happens in Apple Ads and find benchmarks for specific app categories, download Apple Ads Benchmarks Report.