The Ultimate App Monetization Guide for Android & iOS apps in 2023

Gabriel Kuriata

Gabriel Kuriata  Gabriel Kuriata

Gabriel Kuriata App monetization is the process of generating revenue with a mobile application. It’s conducted with diverse strategies and utilizes a wide array of tools and tactics. Key factors that shape this process are the target market of the app, its category and intended purpose, as well as its unique mechanics and functionality.

In a nutshell, app monetization can acquire revenue directly from users (in form of purchases and subscriptions) or indirectly, by selling ad space with the integration of app monetization platforms or non-protected user data.

All apps can utilize some form of app monetization. All should. The diversity of possible methods of earning money with apps means there’s something in the basket for everyone, allowing for the publisher and developer to be rewarded for their hard work and users to enjoy a great user experience for a good price.

Why is money important? Seriously, who needs food to go on ;)?

Jokes aside, there’s a 99% probability that you DO want to make money with your app. It’s great, because users out there are willing to spend it. Statista (as always) has some hard data to back this statement.

Total revenue generated by apps is expected to hit close to $490 billion by the end of 2022 and go over $640 billion in 2027 (for both iOS and Android systems). Despite the chilling creep of inflation & associated challenges, things are looking good right now. The estimated $490 billion is built by roughly over 50% with ad revenue and a small but still impressive amount of more than $5 billion left for good-old paid app downloads. This will also look good in the future, as the projection is for growth. The cake is there. It might take a little effort (and as always – optimization) to cut a piece, but you will have your piece. After all, today even a free app can make money.

Okay, there is a population of apps that don’t really make money per-se, but are crucial on a user’s journey towards a purchase. Your air filters app is a part of its unique selling point. An app with coupons that can be exchanged for real good in the store drives sales. In their case, engagement is their money. But these aren’t the scope of this article. Here, we describe strategies for making hard (well, digital) cash through apps.

What’s more, you’ll be able to have your share with all direct & indirect strategies described in this guide.

“While overall consumer spending on mobile dropped by 2% in 2022, if we remove gaming, global app revenue grew by 8% to $33bn. The cause of this growth? The resilience of the subscription monetization model, even in the face of declining disposable income. But some countries grew more than others, which brings us to a key theme for 2023: localization. This is where the next golden age of subscription app growth is likely to be found — expanding into new growing markets with tailored content.”

Before we dive in into the various app monetization models, let’s discuss absolutely fundamental key performance indicators that we should understand:

Regardless of what an app does, these matter. Users find you either organically or through ads. They engage, stay for some time, generate some revenue, churn… or even return after deleting your app. You can always go deeper or specialize more. One thing is really worth remembering though:

User acquisition costs money. Don’t count on organic miracles. Remember that marketing KPIs (ROAS, CPA, CPT) must be an integral part of your monetization plan. Good ARPU for a game might be a disaster for a financial app, as the finance category on the App Store is much more expensive in terms of clicks and downloads. Study our benchmark reports and keep them in mind while planning your app monetization strategy.

Download the latest Apple Ads Search Results Benchmarks Report

You may take above-mentioned 7 key performance indicators and display them on a large screen or a wall for everyone to see, but the fact of the matter is your team will have to keep track of many, many metrics to deliver them.

The multitude of methods and tactics leads to an exponential increase in various parameters that a developer or a publisher should track (as if we didn’t have enough acronyms already ;)).

Daily active users, monthly active users length of session, tap-through rate, completion rate, time to first purchase… and there’s more, depending on the monetization strategy and app functionality.

There are four types of app monetization models and most app publishers use more than one.

This app monetization model of selling digital assets inside the app. From simple “buy the full version” after trying some free content, to entire in-game stores with multitudes of products to choose from. As a remainder, this strategy is responsible for close to 50% of all app revenue generated in 2022.

In-app purchases can be generally divided into two categories:

This category doesn’t include the purchase of physical products through online stores (ecommerce apps). Technically, they can offer in-app purchases, in the form of virtual gift cards, or in some form of loyalty programs (even though the majority of them reward physical purchases in some way).

Try to answer these two questions:

If the answer is yes, in-app purchases are the right decision for your app. User experience is king. There’re plenty of examples of backlash against in-app purchases, but the actual spark is the value of a purchase, not the mechanism itself.

The most successful examples of implementation of this strategy include games, a category practically built on in-app purchases (among all other app monetization methods). Take a look at these apps:

In general, the great strength of in-app purchase is its convenience and flexibility. Any app can create a convincing value proposition and engage app users to spend money. They can be introduced at just the right moment for maximum effect.

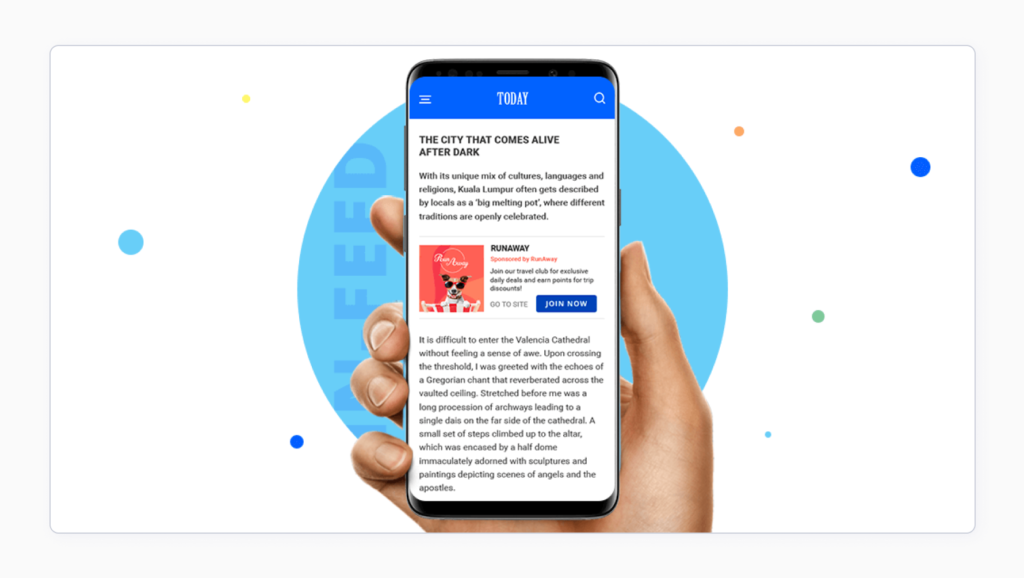

Meet the other half of all in-app revenue generated in 2022: advertisements in apps. In-app advertising means all forms of advertising present within the app. It is the most popular app monetization strategy for mobile apps.

These are the main formats of ads encountered in apps, sorted by mechanic:

In-app advertising is implemented with an ad network, a platform connecting apps selling their space and businesses willing to buy it.

Probably always, with the exception of apps locked behind a paywall (either completely or partially). In-app advertising is a crucial part of revenue generation for a majority of app publishers. Given the many possible formats of advertising and triggering mechanisms, developers need to consider:

Ads work, but they need some time to reach a desired level of LTV and ARPU.

Careful competitive analysis and benchmarking (as well as strict guidelines from Apple and Google) can give us a set of best practices for any app category out there.

In practice, given the differences in app design, finding the right balance between maximizing profits and giving a good user experience seems like an impossible task without A/B testing and optimization during development.

User willingness to see and engage with ads depends heavily on the app itself. Theoretically, even less engaging formats (like banners) can add their share to your revenue stream. Remember, user experience is key.

Anyway, besides choosing the right app monetization platform, the other integration absolutely crucial to the success of this strategy is a cooperation with a mobile measurement partner (MMP). Without implementing a good measurement and analytics system in your app to tell you exactly how users interact with your app you won’t be able to tell why the money is or isn’t flowing.

I’m more likely to engage with a reward video if you don’t kill me in your game right away. Or if it’s too easy. Thank you!

Intrusive ads can have dramatic impact on engagement, so you can be quite certain that top mobile apps in any category do them right – given the overwhelming popularity of this revenue generating strategy.

Again, the highest probability of encountering truly optimized and successful benchmarks is in the gaming category.

In any case, analyzing ad frequency, rewards for videos etc. should be a part of your competitive analysis.

Subscriptions focus on acquiring a stable, long-term income from a user.

We can distinguish two types on in-app subscriptions:

Subscriptions can be a steady and reliable income source. However, churn will always remain a challenge, as well as finding the right balance between functionalities offered in the free model and locked behind a plan.

When your app is meant to be used continuously and in a longer term. There’s no surprise that this model is frequently utilized by streaming services, fitness & health apps as well as those targeted at prosumers or needing mobile apps for work – connectivity, networking, communication, financial services, productivity apps, maps, navigation and so on.

Even though encountered at times, this strategy is seldom used by game publishers. A gamers lifetime value is always finite and even the most addicted players can generate more revenue through in-app purchases than through a subscription.

It’s pointless to mention apps like Netflix, Amazon Prime, as their success relies purely on their content (and to some extent – pricing) than the subscription model itself.

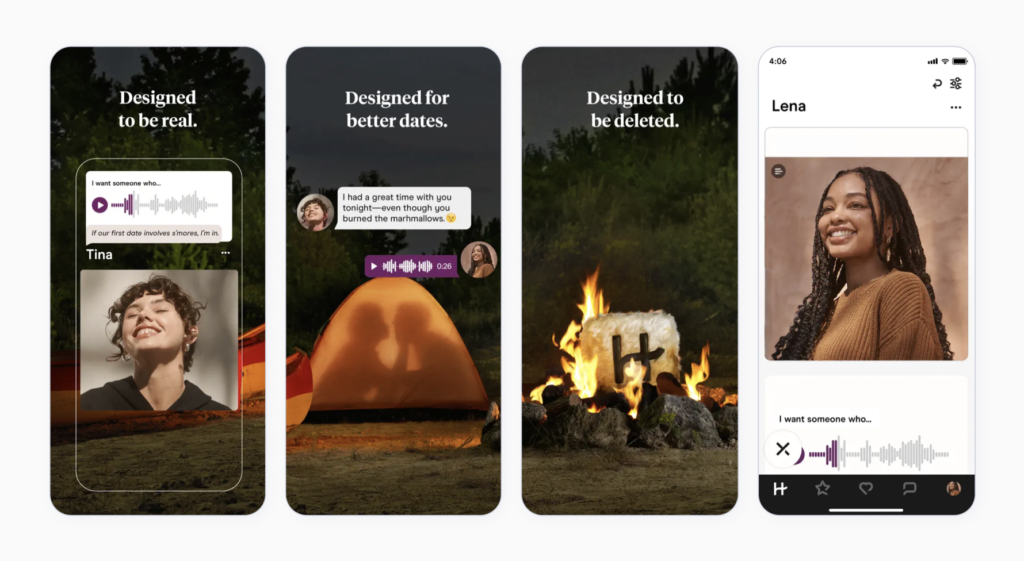

Instead, we can have a look at examples of freemium subscriptions done right, as these require more careful optimization and depend in a big way on functionality.

We can give one piece of advice here: take care of user experience. Offer value and pull users instead of pushing them to subscriptions. Intrusive ads with the “remove ads” option is a much worse idea than giving people something extra in a plan.

In November of 2022, around 94% of all apps were free to download according to Statista. As in previous years, this value was a bit higher for Google Play (paid apps constitute around 10% on the App Store). Still, there are cases when this strategy makes sense. This method brought over $5 billion in revenue in 2022 after all.

It’s as simple as can be: you pay and you download your app.

No fancy mechanics here. Move along.

There are situations when this strategy is viable:

Financial apps meet these criteria, as well as other productivity tools and apps used for work (sometimes those are extensions of more complex software suites that function also on a PC). But also certain indie-games or games made by well known app developers use it.

You may see paid apps in almost every category, with known brands in Finance, Utility categories. However, the “try before you buy” is becoming the default model in an increasingly competitive environment… and inflation.

Upon reaching a certain threshold of users (tens of thousands a day), your app inevitably has access to a sample population that may be of great value to companies interested in it. Mainly advertisers.

Mobile app data monetization means collecting, segmenting and the transferring of non-personal identifiable information about users to the data collectors. Data monetization doesn’t doesn’t include personal data! Information that data collectors usually gather is:

As this mobile app monetization strategy involves anonymized, non-personal identifiable data, collectors are usually looking to buy it in bulk. The more non-personal data they acquire, the more precise it becomes. This is why app developers need to focus on building their user base before implementing it.

This strategy can be utilized by any app that reaches a certain level of user base. The big advantage of this app monetization strategy is that it entirely works in the background through a data monetization SDK. Keep in mind that recent developments in terms of privacy protection (like the necessity of acquiring and explicit permission from the user to gather any data and to specify its exact range) may make it more challenging.

Data monetization fueled the growth of Google, Facebook and Amazon (among many), although many apps with a sufficient daily or monthly user base can do it too.

Almost no apps rely on a single strategy to generate revenue. Mixing of strategies and diversifying revenue streams is THE trend for 2023 and beyond.

Hybrid monetization is the strategy of using multiple methods of generating revenue in an app. Do you run ads in your game and also offer a premium upgrade to get rid of them… but still keep those highly engaging reward videos? That’s a hybrid strategy 101.

Even pay per download strategy doesn’t exclude the possibility of utilizing in-app purchases, as even the most expensive app can have even more extensions and DLCs.

Save perhaps with apps built around premium subscription models (like Netflix and so on) – probably always.

Segmentation is key. Your app attracts various users. Test, optimize and explore your audience. Your freemium app’s paid subscription may be an impassable wall for some users, but they’d gladly buy some small packages of assets. Having one option doesn’t need to hurt the other.

Even with more intricate monetization mechanisms that CAN alienate some more casual users (this involves consumable in-app purchases with influence on gameplay), there’s the term “acceptable losses”. In other words, you can sacrifice some part of the audience if it maximizes your profits and doesn’t jeopardize other KPIs.

You can minimize these losses while still maximizing profits with offerwalls. They’re similar to in-game stores and give non-paying users a chance to try premium features and increase the chances of future in-app purchases.

Offerwalls provide a non-intrusive and 100% opt-in ad experience, because users choose how, when, and if they want to interact with ads. This minimizes the disruptions caused by ads during gameplay, while providing a reliable source of revenue for app publishers.

This one’s easy. With revenue almost evenly split between in-app ads and in-app purchases and most apps doing both things – most top apps on the App Store (or Google Play for that matter) are fine examples of implementing hybrid app monetization strategy.

Most apps use hybrid monetization strategy. But it should be obvious by now that there are significant differences between app categories.

No matter what app monetization models and strategies you’re implementing, having a solid first-party data foundation that enables you to deliver a positive user experience is key to retain and grow your user base profitably.

You’d be surprised how much an app developer can test before the mobile app is even released on an app store. App monetization method of your choice is something that will be reflected or at least implied in the creative assets visible on your product page. Sophisticated testing tools like SplitMetrics Optimize can allow you to test reactions to varying models.

Let’s start with a category with ubiquitous monetization mechanisms, despite the audience allegedly hating them… and spending ungodly amounts of money on them anyway. Games, the absolutely top income generator (over 50% even by a glance) according to Statista.

We recommend asking these questions to decide on the best strategy for your game:

Behavioral segmentation is key and there are numerous factors to consider, but the very basis is as described above: expected relationship time and engagement, depending on the complexity of your game.

Dating apps: a desert for some and an overwhelmingly lush garden for others. The very nature of dating apps may incentivize users to invest in premium subscriptions to improve their user experience. More search options or more filters. Extended range or more search criteria.

Extended lifecycle of these apps encourages top publishers to focus on the freemium model with other strategies holding supportive streams of revenue.

Financial apps are vehicles for value generation in themselves. Meant for long-term use and targeted at prosumers or specialists who might be willing to pay for more options or a better user experience. Freemium, premium subscriptions as well as pay-per download are viable in this category.

Freemium subscriptions and advertising are the way to go. In-app purchases with extra content may be used with great effect.

Logically, an educational app may offer similar incentives as a financial app. Its value for a user relies on long term engagement, best ensured through a freemium subscription, with additional special offers and extensions in the form of in-app purchases.

More casual users may enjoy incentivized advertising in the form of rewards for watching videos (like unlocking next steps in educational courses).

This category is dominated by giants, making money on native ads and data monetization. You idea for making money largely depends on the niche you find.

There’s a strong perception (and data to support it) that the Apple App Store is the place where the money is. According to Statista, as of 2022, Apple’s iOS enjoyed a 27.5% market share in terms of operating devices, compared to Google’s 71.8%.

It’s a 2:1 ratio for Android in terms of market share and downloads… but it’s inverted for revenue.

Apple’s iPhone is a high end device priced accordingly. The openness of Android enabled it to penetrate segments with lower income on a global scale. No surprise that higher engagement and willingness to pay are more visible on the App Store.

Don’t underestimate Android and Google Play however. Its great strength is the diversity of devices and upward mobility of its users, as well as the market share. Revenue for Google Play is growing faster than on the App Store.

All aforementioned strategies work on Google Play. The key words to understanding the difference between two platforms is BALANCE. Of strategies and income sources.

You may find more success with direct purchases on the App Store but keep in mind incoming challenges that may result in bigger reliance on in-app advertising.

Sell ad space! Tight, well implemented integration is fundamental for your success, as well as carefully planned in-app purchases.

All in all, the mix of strategies remains the same. It’s possible that without simultaneous presence on Google Play, many apps would lean towards more straightforward monetization tactics and rely less heavily on in-app advertising. Testing and optimization is the way to strike the right mix and communicate your value proposition and what is expected for it in a way engaging for both platforms.

There’s one thing to say here: you really do have many options for app monetization platforms to sell your ad space. With varying functionalities and being tailored at different niches, we can highlight the three biggest ones, holding the majority of the market.

According to Statista, Google’s platform had 80% integration share on the App Store in 2022. User friendly, with a high quality ad inventory and no entry barriers, it’s a great choice for beginners.

Facebook Ads (Meta Audience Network) were utilized by close to 20% of apps on the App Store in the same period. The key category is gaming, where users are highly engaged.

Unity Ads followed in third place, with 15% integrations. The main category utilizing this platform are games, many of which are based on the engine. It offers anything a mobile game publisher or developer could want, with additional great analytics.

General projections may be optimistic, although due to current market conditions challenges lie ahead. Better be safe than sorry, so here are our top 3 tips for this year, correlated with the 3 biggest trends.

Ad Revenue continues to be under pressure as Privacy Related initiatives force Ad-Monetisation Managers to continuously monitor & update their strategies and allowing for testing of new formats and placements. Being able to quickly see how your placements are performing on a granular level (e.g. network, country, ad-type) and keeping a tap on your fill rates all imperative part of a standard day to day. At Singular we are here to make sense of if all through our Ad-Monetisation Dashboard where Ad-Monetisation Managers can closely evaluate the performance of their strategy, get the level of granularity they need and distinguish between Ad-Revenue and IAPs.

In app purchases and freemium models might rule on the app store, but be prepared for the increasing role of ads in following years. The answer to that is simple: inflation and the possibility of users holding more tightly to their cash, even on the App Store.

More ads mean worse user experience… but it doesn’t have to be this way. Ads are a part of mobile-online life now. They can be useful and engaging if done right. Place user experience first. Then think how you can organically integrate your ads into that experience.

There’s another reason interactive and reward ads switched on out of users own volition may be more and more important. Increasing measures taken by Google and Apple to protect their users’ privacy should incentivize app developers and publishers to rely on their own sources of data. A reward video is triggered by a special event, by engaging a user. This is something you may have complete control over, thanks to a mobile measurement partner integration. The ad may not be precise, but the experience will be more tolerable to the user.

Learn more about mobile measurement partners in this article: “Best mobile measurement partners in 2022”

To wrap things up: test and optimize to create a healthy mix for you and your users. Diversify and place user experience above all else. Remember, that your product pages are an integral part of your monetization plan. People know you’ll want to make money so don’t make empty promises, don’t hide anything.

With this, we hope 2023 will be great for your app :)